Data Commercialisation: How To Get Your Slice Of A $10 Trillion Industry

03 Nov

You might have heard the phrase: ‘data is the new oil’. However, this might be overly generous to the oil industry.

Last year, Statistic Canada estimated the total value of the country’s total data to be anywhere between $US118bn-$US164bn ($163bn-$227bn). Given Canada has a 1.35 per cent share of the global GDP, it is fair to assume the global data economy could be worth anywhere upwards of $US10 trillion.

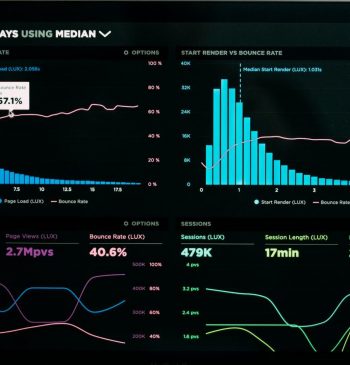

The digital transformation projects that so many businesses have undertaken in recent years have left behind endless troves of data that has the potential to be monetised.

Research from Forrester found that in 2019, 51 per cent of global data and analytic business decision makers reported selling or sharing their data, up from 32 per cent in 2016.

This figure looks set to increase again in the near future.

Speaking about what we can expect in 2021, Forrester VP and research director Ashutosh Sharma recently said: “The pandemic accelerated the need for digital transformation. The current economic climate has increased the urgency for every enterprise to embrace technology as a strategic asset.”

So how can you turn these decimals into dollars and tap into the data economy? The answer lies in data commercialisation.

The idea behind data commercialisation is relatively simple: take existing company data and turn it into new revenue streams.

It takes data and reframes it to a company asset.

And while it might be simple in theory, in practise, data commercialisation brings with it a number of challenges.

What to consider

There are a number of commercial, regulatory and ethical considerations to weigh up before you launch into data commercialisation.

Firstly you need to consider the changing regulatory framework regarding data use and general privacy. The EU’s General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA) are both already having global impacts, while Australia is currently preparing for a landmark review into the current Privacy Act. These frameworks don’t preclude the use of data, but are very much controlling how it can be used.

There are also ethical considerations to weigh up. As an example, Google acquired wearables brand Fitbit for $US2.1 billion last year due in no small part to the value of its data. However, consumers have voiced their concern around health data being shared for commercial purposes.

Cashing in

As KPMG points out, data is one of the only corporate assets that can be both appreciating and depreciating simultaneously.

“While historical data may lose value with respect to short cycled transactional opportunities, it may be gaining value from a trending and long cycle strategic perspective,” the firm said.

Recognising the dynamic nature of data is critical for any business looking to launch a successful data commercialisation strategy.

Given the wide range of data that is collected by different businesses, there are a number of different ways in which data can be monetised.

There is also the challenge of ensuring your data is fit for sale.

Valuing data also presents a challenge. Data that is valuable to one customer might be of absolutely no value to another.

For data to be valuable, it needs to be:

- clean and structured

- have a fresh and reasonably constant flow of updated data coming through

- have a target market

- sourced and managed compliantly

- secure

- able to connect to other data sets

At smrtr, our proprietary data commercialisation framework helps value data and identify which aspects of the data are of value.

We also work with external data companies to combine multiple data sets and uncover valuable insights.

While all data is valuable, it only becomes commercially viable when it is clean, structured and usable.

Many businesses don’t have their data adequately cleaned for internal use, let alone in a state that’s fit for sale.

With our data audit service, we can structure data not just for data commercialisation but also for internal use and assistance with decision making.

This could in turn help identify why customers are churning or highlight which customers are more likely to purchase a new product.

Additionally, by enhancing your internal data with external data sets it immediately becomes much more powerful and internal decision making can be improved.

If you’d like to learn more please, contact us and we’ll be in touch within the next business day.

By Dave Palin, GM Partnerships at smrtr